Work Study: Method Study, Time Study & Motion Economy

What is Work Study? (Concept & Definition)

Work Study is a generic term for techniques (Method Study and Work Measurement) used to examine human work in all its contexts. Its goal is to systematically investigate all factors affecting the efficiency and economy of a situation to effect improvement.

In simple terms, it is the analysis of a job to find the best way to do it (Method) and the standard time required to complete it (Time).

History & Pioneers:

-

F.W. Taylor (Scientific Management): Known as the father of Time Study. He focused on “A definite task, a definite time, and a definite method.”

-

Frank & Lillian Gilbreth: The pioneers of Motion Study. They analyzed body movements (bricklaying) to reduce fatigue and waste.

Objectives of Work Study:

-

Simplify Work: Make the job easier and safer for the worker.

-

Standardization: Set standard methods and times for production planning.

-

Cost Reduction: Eliminate wasteful activities to lower manufacturing costs.

-

Productivity: Increase output with the same resources.

The Two Techniques of Work Study

Work Study is composed of two complementary techniques:

1. Method Study (Motion Study)

-

Definition: The systematic recording and critical examination of existing and proposed ways of doing work to develop easier and more effective methods.

-

Goal: To improve the process and layout.

-

Key Steps (SREDIM):

-

Select the job.

-

Record the facts (using charts).

-

Examine the facts critically (Why is this done? Who does it?).

-

Develop the new method.

-

Install the method.

-

Maintain the method.

-

2. Time Study (Work Measurement)

-

Definition: The application of techniques to establish the time for a qualified worker to carry out a specified job at a defined level of performance.

-

Goal: To set Standard Time for incentive schemes and scheduling.

Recording Techniques: Process Charts

To analyze a method, we must first record it visually. We use symbols (Circle=Operation, Square=Inspection, Arrow=Transport, D=Delay, Triangle=Storage).

Types of Charts:

-

Operation Process Chart: Shows only the main operations and inspections. Used for a bird’s-eye view.

-

Flow Process Chart: A detailed chart showing all events (transport, delays, etc.).

-

Man Type: Records what the worker does.

-

Material Type: Records what happens to the material.

-

Equipment Type: Records how the equipment is used.

-

-

Flow Diagram: A scale drawing of the work area showing the path of movement. It helps spot long distances and backtracking.

Principles of Motion Economy

Developed by the Gilbreths, these are rules to design efficient work methods to minimize fatigue.

Key Principles:

-

Use of Human Body: Both hands should begin and end motions together. Hands should not be idle at the same time. Motions should be smooth and continuous (curved), not jerky (zigzag).

-

Arrangement of Workplace: Tools and materials should have a fixed place (pre-positioned). Gravity feed bins should be used to deliver materials close to the point of use.

-

Design of Tools: Combine tools where possible (e.g., a hammer with a screwdriver end). Tools should be designed to use the strongest muscles (palm grip vs. finger grip).

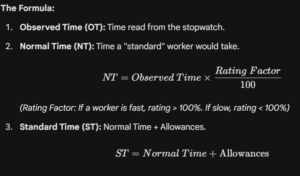

Calculating Standard Time (Solved Numerical)

This is a crucial part of Time Study. You cannot just use the stopwatch time because workers work at different speeds.

Formula for standard time:

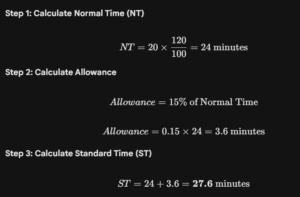

Exam Numerical Example:

An observer records the time for a welding operation as 20 minutes. The observer rates the worker’s performance as 120% (faster than normal). The company policy gives a 15% allowance for fatigue and personal needs. Calculate Standard Time.

Solution:

What are Allowances?

Workers are not machines. They need breaks. Standard time includes these “Allowances”:

-

Relaxation Allowance:

-

Personal Needs: Water, washroom (approx 5-7%).

-

Fatigue: Rest from physical or mental strain (heavy lifting, eye strain).

-

-

Contingency Allowance: For small, unavoidable delays (e.g., tool sharpening).

-

Policy Allowance: Extra time given by management (e.g., for union negotiations or new learners).

Work Study & Productivity

Work Study is the most direct tool to increase productivity.

-

Relationship:

-

Productivity = Output / Input.

-

Work Study reduces the Input (Time, Effort, Waste) to produce the same or more Output.

-

-

Role: It eliminates ineffective time (bad design, bad layout) and sets fair standards, ensuring resources (Men, Machine, Material) are used effectively.

Found a mistake or have a suggestion? We work hard to ensure all notes are 100% accurate. If you spot an error, find a missing subject, or have a request, please [click here to let us know]!

By Lunotes – your trusted for Lucknow University Semester exam notes, crafted with love. ❤️