Financial Management: Scope, Functions & Objectives Profit Maximization vs. Wealth Maximization

Introduction to Financial Management

Finance is the art and science of managing money. Virtually all individuals and organizations earn, raise, spend, or invest money. Financial Management is broadly concerned with the acquisition and use of funds by a business firm.

In earlier years, it was synonymous with just raising funds. Today, its scope has broadened to include the efficient use of resources.

Scope of Financial Management

Financial management focuses on managing money in a smart and planned way. Its main aim is to make sure the business has enough funds and uses them correctly to increase profit and value. The scope of financial management includes the following areas:

1. Financial Analysis, Planning & Control

It means understanding the company’s financial position by analyzing financial statements like Balance Sheet & Profit-Loss account.

Planning helps decide how much money is required and where it will be spent.

Control ensures that money is used properly and not wasted.

Example: Checking budgets, comparing actual performance with planned performance.

2. Profit Planning

Profit planning means deciding the expected level of profit and making strategies to achieve it.

It includes controlling costs, increasing sales, and improving efficiency.

Example: Setting profit targets for the year and preparing plans to reach them.

3. Financial Forecasting

It means predicting the future financial needs of the business.

Helps in estimating cash needs, investment requirements, and financial risks.

Example: Forecasting future sales, future expenses, and capital needs.

4. Acquisition and Use of Funds

It means arranging funds from different sources (like shares, loans, debentures).

Also includes deciding where and how to invest this money to earn the best return.

Example: Raising money from the bank and investing it to buy new machinery.

Objectives: Profit Maximization vs. Wealth Maximization

Every Finance Manager has to ask one question: “What is our ultimate goal?”

There are two schools of thought: the Traditional approach (Make Profit) and the Modern approach (Create Wealth).

1. Profit Maximization (The Old School)

The Idea:

Business exists to make money. Therefore, any decision that increases profit is “Good,” and any decision that reduces profit is “Bad.”

Why it sounds right: It’s simple. Profit measures efficiency. If we are profitable, we survive.

Why it is actually WRONG (The Flaws):

It is Vague: What is “Profit”? Is it short-term profit? Long-term? Before tax? After tax? It is not clear.

Ignores Risk:

Example: Project A gives a guaranteed profit of ₹50,000. Project B gives a profit of ₹1 Lakh but has a 50% chance of failing completely.

A “Profit Maximizer” would choose Project B because the profit is higher, ignoring the huge risk of losing everything.

Ignores Time Value of Money:

Example: Option A gives you ₹1 Lakh today. Option B gives you ₹1 Lakh after 5 years.

Profit Maximization says both are equal (₹1 Lakh = ₹1 Lakh). But common sense tells us money today is more valuable than money 5 years later.

2. Wealth Maximization (The Modern School)

The Idea:

The goal is not just to earn profit, but to increase the Market Value of the company. This is also called Shareholder Value Maximization. The focus is on increasing the share price in the stock market.

The Formula:

Wealth = Number of Shares Owned × Current Market Price per Share

Why it is BETTER:

Considers Risk: It avoids risky projects because high risk makes share prices fall.

Considers Time: It recognizes that cash now is better than cash later. It uses Discounted Cash Flow (DCF) techniques.

Long-Term Focus: It doesn’t cut corners to make a quick buck. It invests in quality, brand, and research, which increases the company’s value over 10-20 years.

Considers Everyone: To keep the share price high, a company must treat customers, employees, and society well. If they cheat customers to make a quick profit, the share price will eventually crash.

Comparison: Which one wins?

| Basis | Profit Maximization | Wealth Maximization |

| Concept | Traditional / Narrow | Modern / Broad |

| Goal | Earn large profits | Increase market value of shares |

| Time Horizon | Short-term focus | Long-term focus |

| Risk | Ignores risk factor | Considers risk factor |

| Time Value | Ignores timing of returns | Recognizes money has time value |

| Best For | Survival stage companies | Established, growing companies |

While Profit is necessary for survival (like oxygen), Wealth Maximization is the ultimate goal (like a healthy life). A good Financial Manager always chooses Wealth Maximization because it accounts for risk, time, and future growth.

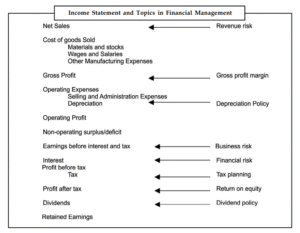

The Three Key Finance Functions (Decisions)

Financial management revolves around three major decisions that must be optimal to maximize firm value.

1. Investment Decision

Where should the firm invest its funds?

Capital Budgeting: Selecting long-term assets (projects) that yield returns in the future.

Working Capital Management: Managing current assets (cash, receivables, inventory) for day-to-day operations.

2. Financing Decision

How should the firm raise funds?

Capital Structure: Determining the right mix of Debt and Equity.

Source of Funds: Choosing between loans, shares, or retained earnings based on cost and risk.

3. Dividend Decision

How much profit should be distributed among stakeholders?

Dividends: Distributing profits to shareholders.

Retained Earnings: Keeping profits for reinvestment in the company.

The manager must decide the optimal dividend payout ratio that maximizes shareholder wealth.

Interface of financial management with Other Functions

Finance is the lifeblood of an organization and connects with all other departments:

Marketing: Finance allocates budget for ads and sales campaigns.

Production: Finance approves funds for machinery and raw materials.

HR: Finance manages payroll and benefits costs.

Economics: Financial managers use economic theories (supply-demand, marginal analysis) for efficient operations.

Accounting: While accountants focus on accrual-based reporting, financial managers focus on cash flows for decision-making.

Understanding Capitalization

Before we jump into “Over” or “Under,” let’s understand Capitalization.

In simple terms, Capitalization is the total amount of money invested in the business (Shares + Debentures + Long-term Loans).

Think of capitalization like a shirt.

Fair Capitalization: The shirt fits perfectly. The capital invested generates just the right amount of profit.

Overcapitalization: The shirt is too loose (Too much capital, too little profit).

Undercapitalization: The shirt is too tight (Too little capital recorded, but massive profit).

1. Overcapitalization

A company is Overcapitalized when it has raised more money than it can profitably use. It sounds like having “too much money,” but in finance, it is a bad situation.

Simple Definition:

When a company’s earnings are very low compared to the huge capital it has invested. It is like buying a Ferrari just to deliver pizzas—the investment is huge, but the return is tiny.

Example:

Imagine Company A invests ₹10 Lakhs. The normal industry return is 10% (so it should earn ₹1 Lakh). However, Company A only earns ₹50,000.

The shareholders invested a lot but are getting very little return.

Verdict: Company A is Overcapitalized.

Symptoms (How to spot it):

Low Dividend: The company cannot pay good dividends because profits are low.

Low Share Price: Since dividends are low, people sell the shares, and the market price falls below the face value (e.g., a ₹10 share trades at ₹8).

Difficulty Raising Loans: Banks won’t lend money because the company isn’t profitable enough.

Causes (Why it happens):

Buying assets at high prices: Buying machinery when it was very expensive.

High Promotion Costs: Spending too much money on ads that didn’t bring sales.

Liberal Dividends: In the past, the company distributed all profits to shareholders and didn’t save anything for the future.

Remedies (How to fix it):

Reduction of Capital: Cancel old shares and issue new ones at a lower value.

Buyback: The company buys back its own shares to reduce the number of claimants on profit.

2. Undercapitalization

A company is Undercapitalized when it has very little recorded capital but is making huge profits. This sounds good, but it has dangerous side effects.

Simple Definition:

When a company’s earnings are exceptionally high compared to the capital invested. It is like a small roadside stall making crores in profit.

Example:

Imagine Company B invests only ₹1 Lakh. The normal industry return is 10% (expected profit ₹10,000). But Company B earns ₹50,000 (a 50% return!).

The return is massive compared to the small investment.

Verdict: Company B is Undercapitalized.

Symptoms (How to spot it):

High Dividend: The company pays huge dividends.

High Share Price: Everyone wants to buy these shares, so the market price shoots up above book value (e.g., a ₹10 share trades at ₹50).

High Secret Reserves: The company has a lot of hidden profit saved up.

Causes (Why it happens):

Buying assets cheaply: Buying a factory during a recession (low price) which is now producing great value.

Conservative Policy: For years, the company saved its profits instead of distributing them, making the company internally very rich.

High Efficiency: The management is super efficient and generates profit out of nothing.

Consequences (The hidden dangers):

Competition: Seeing huge profits, rivals will enter the market to copy you.

Labor Trouble: Workers will demand higher wages seeing the high profits.

Consumer Anger: Customers might feel the company is overcharging them to make such high profits.

Remedies (How to fix it):

Stock Split: Divide 1 share of ₹100 into 10 shares of ₹10. This reduces the earnings per share to look normal.

Bonus Shares: Issue free shares to existing shareholders to convert savings into capital.

| Feature | Overcapitalization (Bad) | Undercapitalization (Risky but Good) |

| Earnings | Very Low | Very High |

| Share Price | Lower than Face Value | Higher than Face Value |

| Real Value | Assets are worth less than recorded. | Assets are worth more than recorded. |

| Remedy | Reduce Capital / Buyback | Issue Bonus Shares / Stock Split |

Conclusion:

Financial management is more than just procurement of funds. It is about the optimal combination of investment, financing, and dividend decisions to maximize the wealth of shareholders while maintaining ethical standards and stakeholder relationships.