In-depth about The Accounting Equation, Cycle & Classification of Accounts

Guide to the Accounting Equation, Cycle, and Classification of Accounts

For BBA and MBA students, understanding the core principles of accounting is essential. This guide breaks down the three most fundamental concepts: the Accounting Equation, the Accounting Cycle, and the Classification of Accounts.

1. The Accounting Equation

The Accounting Equation is the absolute foundation of the double-entry bookkeeping system. It shows that what a business owns (its Assets) must be equal to the claims against those assets—what it owes to outsiders (Liabilities) and what it owes to its owner (Capital).

The equation is:

Assets = Liabilities + Capital (or Owner’s Equity)

This equation is the basis for the Balance Sheet and must always remain in balance. Every single business transaction affects this equation in at least two places.

Understanding the Components

-

Assets: What the business owns (e.g., cash, land, machinery, inventory, debtors).

-

Liabilities: What the business owes to outsiders (e.g., bank loans, creditors for goods).

-

Capital (Equity): What the business owes to its owner. This is the “residual claim”—what is left for the owner after all liabilities are paid.

Equity = Assets – Liabilities

How Transactions Affect the Equation

-

Owner Invests Cash: Assets (Cash) increase and Capital increases.

-

Take a Bank Loan: Assets (Cash) increase and Liabilities (Loan) increase.

-

Repay a Loan: Assets (Cash) decrease and Liabilities (Loan) decrease.

-

Buy an Asset: One Asset (e.g., Machinery) increases and another Asset (e.g., Cash) decreases.

-

Earn Revenue (in cash): Assets (Cash) increase and Capital (Revenue) increases.

-

Pay an Expense: Assets (Cash) decrease and Capital (Expense) decreases.

2. The Accounting Cycle

The Accounting Cycle is the complete, step-by-step process of recording, classifying, and summarizing business transactions. It’s a continuous sequence that begins with a transaction and ends with the preparation of the final financial statements.

The 6 Key Steps of the Accounting Cycle

-

Analyze Transactions: The first step is to analyze a transaction from its source document (e.g., an invoice, order, or check).

-

Prepare Journals: The transaction is recorded for the first time in a Journal, also known as the “book of original entry.”

-

Post to Ledger Accounts: This is the classifying step. All journal entries are transferred (or “posted”) to their respective Ledger Accounts (e.g., all cash transactions go to the Cash A/c).

-

Prepare a Trial Balance: This is the summarizing step. A Trial Balance is a list of all ledger account balances. It is prepared to check if the total debits equal the total credits, ensuring the books are arithmetically correct.

-

Post Closing Entries: At the end of the period, all temporary accounts (Revenue and Expense accounts) are “closed” (their balances are transferred) to the Capital account to calculate the final profit or loss.

-

Prepare Financial Statements: The final step is to prepare the Trading Account, Profit & Loss Account, and Balance Sheet from the adjusted trial balance.

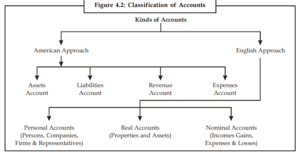

3. Classification of Accounts

To properly record transactions in the Journal and Ledger, you must know what kind of account you are dealing with. There are two main ways to classify accounts: the English Approach (Traditional) and the American Approach (Modern).

English Approach (Traditional)

This approach divides all accounts into three main types.

| Account Type | What It Is | Examples |

| 1. Personal Account | Accounts related to all persons, firms, companies, or representative groups. | Ram’s A/c, SBI Bank A/c, ABC Ltd.’s A/c, Outstanding Salary A/c (representative). |

| 2. Real Account | Accounts of all assets and properties of the business. | Land A/c, Machinery A/c, Cash A/c, Goodwill A/c, Patent A/c. |

| 3. Nominal Account | Accounts of all Incomes, Expenses, Losses, and Gains (easily remembered by the acronym “IELG”). | Rent A/c, Salary A/c, Commission Received A/c, Loss by Fire A/c. |

American Approach (Modern)

This approach classifies accounts based on the accounting equation (A = L + C).

-

Assets Accounts: All business assets (e.g., Plant, Machinery, Land, Cash, Debtors).

-

Liabilities Accounts: All outsider claims (e.g., Loans, Creditors, Bills Payable).

-

Capital Account: The owner’s investment in the business.

-

Revenue Accounts: All incomes and gains (e.g., Sales, Interest Received, Commission).

-

Expenses Accounts: All costs and losses (e.g., Repairs, Rent, Salaries, Insurance).

Keep Studying!

We hope these Financial Management and Accounting notes help you build a strong foundation for your BBA. LuNotes is your one-stop solution for all Lucknow University notes. Don’t forget to check out our notes for other subjects in your semester!

-

[Link to Principles of Management Notes]

-

[Link to Personality Development Notes]

-

[Link to Complete Computer application Notes]

Found a mistake? We work hard to ensure all notes are 100% accurate and as per the latest LU syllabus. If you spot an error or have a suggestion, please [click here to report it]. (You would link this text to a contact form or email).

By LuNotes – your trusted for Lucknow University Semester exam notes, crafted with love. ❤️