Product Pricing: Concepts, Objectives & Strategies

Introduction to Product Pricing

Concept and Meaning

Price is the value of a product or service expressed in monetary terms. It is the amount of money a customer must pay to acquire a product.

However, price is more than just a number on a tag. It is a measure of the value or utility a customer expects to derive.

Equation: Value = Benefit / Price

If the benefit is high and the price is low, value is high. If the price is high and benefit is low, value is low.

Nature and Scope of Pricing Decisions

Pricing is a critical element of the Marketing Mix (4Ps) for several reasons:

The Only Revenue Generator: Product, Place, and Promotion are all costs to the company. Price is the only element that brings money in.

Highly Flexible: Unlike product features or distribution channels which take months to change, price can be changed in minutes to react to market conditions.

Psychological Indicator: Price creates the first impression of quality. High price often signals luxury; low price often signals inferiority or a bargain.

Profit Determinant: A small increase in price (if volume stays stable) can lead to a massive increase in net profit.

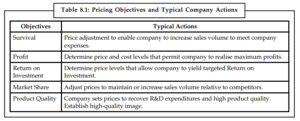

Objectives of Pricing

Before setting a price, a firm must decide what it wants to achieve. The pricing goal determines the strategy.

1. Survival (Short-Term Goal)

If a company is facing intense competition, changing consumer tastes, or overcapacity, its main goal becomes survival. It sets low prices just to cover variable costs and stay in business.

2. Current Profit Maximization

Many companies estimate the demand and costs at different prices and choose the price that produces the maximum current profit, cash flow, or return on investment (ROI).

3. Market Share Leadership

Some companies believe that higher sales volume will lead to lower unit costs and higher long-term profit. They set the lowest possible prices to grab the largest slice of the market.

Example: Reliance Jio entering the telecom market with free/low-cost plans.

4. Product Quality Leadership

A company might aim to provide the best quality product in the market. This requires charging a high price to cover high R&D and production costs.

Example: Mercedes-Benz or Apple.

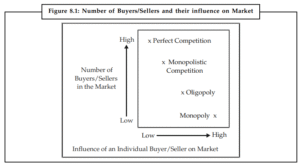

5. Status Quo Pricing

This objective is common in oligopolies (markets with few sellers). The goal is to stabilize prices and avoid price wars by following the market leader’s price.

Factors Affecting Pricing Decisions

Pricing is never done in a vacuum. It is influenced by two sets of factors:

A. Internal Factors (Controllable)

These factors are within the control of the organization.

Cost of Product: This sets the floor (minimum) price. The company must charge a price that covers fixed costs (rent, salaries) and variable costs (raw materials) plus a fair profit.

Marketing Objectives: As discussed above (Survival vs. Quality Leadership).

Product Differentiation: If your product is unique (differentiated), you can charge a premium. If it’s a commodity (like salt), you must match competitors.

Product Life Cycle: Pricing changes over time.

Introduction: High price (Skimming) or Low price (Penetration).

Decline: Price cuts to clear stock.

B. External Factors (Uncontrollable)

These factors are outside the firm’s control.

Demand: This sets the ceiling (maximum) price. You cannot charge more than what customers are willing to pay.

Elastic Demand: Small price change = Big demand change (Price sensitive).

Inelastic Demand: Price change doesn’t affect demand much (e.g., Petrol, Salt).

Competition: The prices and strategies of competitors (e.g., Pepsi vs. Coke) heavily dictate your price range.

Economic Conditions: Inflation, recession, and interest rates affect consumer purchasing power. In a recession, companies must lower prices.

Government Regulations: Taxes (GST), price controls on essential commodities (medicines, food), and anti-monopoly laws.

Pricing Strategies

Strategies are broad guidelines for setting price. The choice depends on whether the product is New or Existing.

1. New Product Pricing Strategies

When launching a brand new product, companies usually choose one of two paths:

A. Market Skimming Pricing

Setting a high price initially to “skim” revenues layer by layer from the market.

Logic: Sell to the “Cream” (rich/early adopters) first, then slowly lower the price to reach others.

Conditions: Product must have high quality/image; competitors shouldn’t be able to enter easily.

Example: Sony PlayStation or iPhone launches at a high price, which drops after a year.

B. Market Penetration Pricing

Setting a low price initially to penetrate the market quickly and deeply.

Logic: Attract a huge number of buyers quickly to win a large market share and discourage competitors.

Conditions: Market must be price-sensitive; production costs must fall as volume increases.

Example: Netflix or Amazon Prime entering new countries with low subscription fees.

2. Product Mix Pricing Strategies

Product Line Pricing: Setting price steps between products in a line (e.g., Samsung M10 vs M20 vs M30).

Captive Product Pricing: Pricing the main product low but the necessary accessories high.

Example: Printers are cheap, but Ink Cartridges are expensive.

Example: Razors are cheap, but Blades are expensive.

Bundle Pricing: Selling a set of products together at a lower price than buying them individually (e.g., McDonald’s Meal vs. Burger + Fries + Coke separately).

3. Psychological Pricing Strategies

Odd-Even Pricing: Pricing at ₹99, ₹499, or ₹999. Consumers process ₹999 as “900 something” rather than “1000”. It feels significantly cheaper.

Prestige Pricing: Artificially keeping the price high to signal exclusivity and status (e.g., Designer bags).

Pricing Methods (How to Calculate?)

How do managers arrive at the exact number?

1. Cost-Oriented Methods

Cost-Plus Pricing (Markup Pricing): Simply adding a standard markup to the cost.

Formula: Price = Unit Cost + Desired Profit Margin.

Pros: Simple to calculate.

Cons: Ignores demand and competition.

Break-Even Analysis: Setting price to break even on the costs of making and marketing a product. Any sale above this price is profit.

2. Competition-Oriented Methods

Going-Rate Pricing: Setting price based largely on competitors’ prices rather than on company costs or demand. (Common in steel, paper, fertilizer industries).

Sealed-Bid Pricing: Used in B2B or government tenders. The firm sets a price based on what they think competitors will bid, hoping to win the contract.

3. Value-Based Pricing

Setting price based on the buyers’ perceptions of value rather than on the seller’s cost.

The marketer assesses customer needs and value perceptions first, and then sets a price that matches that value.

Example: A painting by a famous artist costs ₹500 in materials but sells for ₹5 Crores because of perceived value.

Price Adjustment Strategies

Companies adjust their basic prices to account for various customer differences and changing situations.

Discount and Allowance Pricing: Cash discounts for paying early, volume discounts for buying in bulk, or seasonal discounts.

Dynamic Pricing: Adjusting prices continually to meet the characteristics and needs of individual customers and situations.

Example: Uber surge pricing or Airline ticket prices changing every hour based on demand.

Geographical Pricing: Adjusting prices based on location (e.g., charging more in remote areas to cover shipping costs).