From Journal Entries to Ledger Posting & Balancing

The Accounting Process: From Journal to Ledger

The accounting process involves identifying, recording, and then summarizing financial transactions. The first two steps of this process are Recording (in a Journal) and Classifying (in a Ledger).

This guide covers the entire process, from understanding the Golden Rules of Accounting to creating journal entries and posting them to ledger accounts.

Part 1: The Journal (The Book of Original Entry)

In accounting, a Journal is the very first book where all day-to-day business transactions are recorded. Because it’s the first place transactions are entered, it is known as the ‘Book of Original Record’ or ‘Book of Primary Entry’.

The word “Journal” comes from the French word ‘Jour’, which means “day.” Transactions are recorded in chronological order (in the order they occur). The act of recording a transaction in the journal is called “Journalising”.

Golden Rules of Accounting (How to Debit and Credit)

To “journalize” a transaction, you must know what to debit (Dr.) and what to credit (Cr.). The rules for this are based on the three types of accounts:

Personal Account

What it is: Accounts for all persons, firms, companies, and representative groups (e.g., Mr. Kamlesh’s A/c, SBI Bank A/c, Outstanding Salary A/c).

The Rule:

Debit the Receiver

Credit the Giver

Real Account

What it is: Accounts for all assets and properties the business owns (e.g., Cash, Machinery, Furniture, Goodwill).

The Rule:

Debit What Comes In

Credit What Goes Out

Nominal Account

What it is: Accounts for all expenses, losses, incomes, and gains (e.g., Salary A/c, Rent A/c, Interest Received A/c, Sales A/c).

The Rule:

Debit All Expenses and Losses

Credit All Incomes and Gains

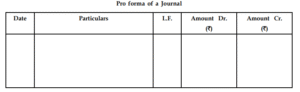

How to Pass a Journal Entry (Proforma)

A journal entry is a systematic record of a transaction. The account to be debited is written first with “Dr.” at the end. The account to be credited is written on the next line, indented, and starts with the word “To”.

This is the standard format (or “proforma”) of a journal:

Proforma of a Journal

| Date | Particulars | L.F. | Amount (Dr.) | Amount (Cr.) |

| :— | :— | :— | :— | :— |

| (Date) | (Account to be Debited) …Dr. | | (Amount) | |

| | To (Account to be Credited) | | | (Amount) |

| | (Being the narration, or explanation of the entry) | | | |

L.F. (Ledger Folio): This column is used to write the page number of the Ledger book where this entry is posted.

Special Types of Journal Entries

1. Compound Journal Entry

A Compound Entry is a single journal entry that involves more than two accounts (e.g., more than one debit and/or more than one credit). This is used when two or more transactions of a similar nature happen on the same day.

Example: On Aug 10, you sold goods to ‘Y’ & Co. for ₹30,000 and received ₹20,000 in cash immediately.

Journal Entry

Date Particulars L.F. Dr. (₹) Cr. (₹) Aug 10 Cash A/c … Dr. 20,000 Y & Co.’s A/c … Dr. 10,000 To Sales A/c 30,000 (Being goods sold and partial payment received)

2. Opening Journal Entry

An Opening Entry is the very first entry passed in the journal at the beginning of a new financial year. Its purpose is to record all the closing balances of assets and liabilities from the previous year’s Balance Sheet. All Assets are debited, and all Liabilities and Capital are credited.

Example: Pass the opening entry on Jan 1, 2006, for Gopinath.

Cash: ₹3,000

Bank: ₹16,000

Stock: ₹30,000

Furniture: ₹5,000

Debtors: ₹21,000

Creditors: ₹18,000

Loan from Ganesh: ₹9,000

The Entry:

Opening Entry – 1 Jan 2006

Date Particulars L.F. Amount (Dr.) (₹) Amount (Cr.) (₹) 2006 Jan 1 Cash in Hand A/c … Dr. 3,000 Cash at Bank A/c … Dr. 16,000 Stock in Trade A/c … Dr. 30,000 Furniture & Fittings A/c … Dr. 5,000 Sundry Debtors A/c … Dr. 21,000 To Sundry Creditors A/c 18,000 To Ganesh & Co. A/c 9,000 To Capital A/c (Balancing Figure) 48,000 (Being opening balances brought forward)

Part 2: Subsidiary Books (The Sub-division of Journal)

If a business is large, it will have thousands of repetitive transactions (like sales, purchases, and cash payments). Recording every single one in the main Journal would make it too bulky and hard to manage.

To solve this, the Journal is sub-divided into special journals, which are called Subsidiary Books. Each book is used to record one specific type of repetitive transaction.

The 8 Key Subsidiary Books

Cash Book: Records ALL transactions involving cash and bank (receipts and payments). It has both a debit and credit side and acts as both a journal and a ledger account.

Purchase Book (Purchase Day Book): Records ONLY credit purchases of goods (the items you buy to resell).

Sales Book (Sales Day Book): Records ONLY credit sales of goods.

Purchase Return Book (Return Outward Book): Records goods returned to suppliers. This is often based on a Debit Note.

Sales Return Book (Return Inward Book): Records goods returned by customers. This is often based on a Credit Note.

Bills Receivable Book: Records all Bills of Exchange and Promissory Notes received from debtors.

Bills Payable Book: Records all Bills of Exchange and Promissory Notes accepted (to be paid to) creditors.

Journal Proper (or General Journal): This is the “real” journal. It is used to record all transactions that cannot be recorded in any of the other 7 subsidiary books.

What Goes into the Journal Proper?

The Journal Proper is used for all non-repetitive, non-cash, and non-goods transactions. This includes:

Opening Entries (as shown above)

Closing Entries (at the end of the year)

Adjustment Entries (e.g., for depreciation, outstanding salaries)

Rectification Entries (to correct mistakes)

Credit Purchase/Sale of Assets:

If you buy Goods on credit, it goes in the Purchase Book.

If you buy Furniture on credit, it goes in the Journal Proper. (Entry:

Furniture A/c ...Dr. / To Supplier's A/c)

Part 3: The Ledger (The Principal Book of Accounts)

While the Journal records transactions as they happen, it doesn’t provide a complete picture of an account. A Journal doesn’t answer queries like:

How much is the total amount due from a specific debtor?

How much do we owe to a specific creditor?

What is the total balance of our Cash account?

To answer these, we prepare the Ledger. The Ledger is the principal book of accounts where all transactions from the journal are classified and grouped into individual accounts. It is a set of all accounts (Personal, Real, and Nominal).

Forms of Ledger

Bound Ledger: The traditional method where the ledger is a single, bound notebook.

Loose-Leaf Ledger: A more modern and flexible method where each account is on a separate, loose sheet. This allows for new pages to be added, old accounts to be removed, and accounts to be easily rearranged.

Part 4: Posting (From Journal to Ledger)

Posting is the process of transferring entries from the Journal (or Subsidiary Books) to their respective accounts in the Ledger.

If a journal entry debits the Rent Account, posting involves going to the Rent Account in the ledger and recording that amount on its debit side.

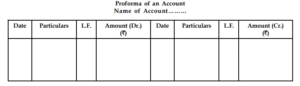

Proforma of a Ledger Account

A ledger account is presented in a “T” format, with a debit (Dr.) side on the left and a credit (Cr.) side on the right.

Dr. (Debit Side) Name of Account Cr. (Credit Side)

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

| :— | :— | :— | :— | :— | :— | :— | :— |

| | | | | | | | |

J.F. (Journal Folio): This column is used to write the page number of the Journal where the original entry is located.

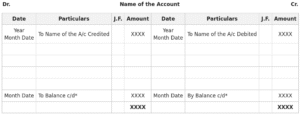

Rules of Posting

The word “To” is used before the account name written on the debit side of a ledger account.

The word “By” is used before the account name written on the credit side of a ledger account.

All accounts from the Journal are opened in the Ledger.

If an account is debited in the Journal, the posting in the Ledger will be on the debit side of that account.

If an account is credited in the Journal, the posting in the Ledger will be on the credit side of that account.

Crucial Rule: The name of the account being posted is not written in the particulars. Instead, you write the name of the other account in the journal entry.

Example: For the entry

Rent A/c Dr. To Cash A/c, when you post to the Rent A/c, you will write “To Cash A/c” on the debit side. When you post to the Cash A/c, you will write “By Rent A/c” on the credit side.

Part 5: Balancing an Account

At the end of an accounting period (e.g., a month or year), the businessman needs to know the final position of each account. Balancing is the process of totaling the debit and credit sides of an account to find the net difference.

How to Balance

Total both the debit side and the credit side separately.

Find the difference between the two totals.

Write this “difference” on the side that has the smaller total, so the two totals become equal.

Label this difference as “By Balance c/d” (carried down) if you wrote it on the credit side, or “To Balance c/d” if you wrote it on the debit side.

Finally, carry this balance down to the opposite side of the account below the total, labeling it “To Balance b/d” (brought down) to start the next period.

Balancing Different Types of Accounts

Asset Accounts (Real Accounts): These are balanced and will almost always have a Debit Balance (e.g., Cash, Plant, Furniture).

Liability Accounts (Personal Accounts): These are balanced and will almost always have a Credit Balance (e.g., Creditors, Loans).

Capital Account (Personal Account): This is balanced and will have a Credit Balance.

Expense & Revenue Accounts (Nominal Accounts): These accounts are not balanced. They are simply totaled at the end of the year. The totals are then transferred to the Trading and Profit & Loss Account to find the net profit or loss.

Part 6: Comprehensive Example (Journal -> Ledger -> Balancing)

Let’s record the following transactions in a Journal and then post them into a Ledger.

Transactions:

Jan 1: Commenced business with cash ₹50,000

Jan 3: Paid into bank ₹25,000

Jan 5: Purchased furniture for cash ₹5,000

Jan 8: Purchased goods and paid by cheque ₹15,000

Jan 8: Paid for carriage ₹500

Jan 14: Purchased Goods from K. Murthy ₹35,000

Jan 18: Cash Sales ₹32,000

Jan 20: Sold Goods to Ashok on credit ₹28,000

Jan 25: Paid cash to K. Murthy in full settlement ₹34,200 (Discount = ₹800)

Jan 28: Cash received from Ashok ₹20,000

Jan 31: Paid Rent for the month ₹2,000

Jan 31: Withdrew from bank for private use ₹2,500

Journal

| Date | Particulars | L.F. | Amount (Dr.) (₹) | Amount (Cr.) (₹) |

| Jan 1 | Cash A/c …Dr. | 50,000 | ||

| To Capital A/c | 50,000 | |||

| (Commenced business with cash) | ||||

| Jan 3 | Bank A/c …Dr. | 25,000 | ||

| To Cash A/c | 25,000 | |||

| (Cash paid in the Bank) | ||||

| Jan 5 | Furniture A/c …Dr. | 5,000 | ||

| To Cash A/c | 5,000 | |||

| (Purchased furniture for cash) | ||||

| Jan 8 | Purchase A/c …Dr. | 15,000 | ||

| To Bank A/c | 15,000 | |||

| (Purchased goods and paid by cheque) | ||||

| Jan 8 | Carriage A/c …Dr. | 500 | ||

| To Cash A/c | 500 | |||

| (Cash paid for carriage charges) | ||||

| Jan 14 | Purchase A/c …Dr. | 35,000 | ||

| To K. Murthy | 35,000 | |||

| (Goods purchased on credit) | ||||

| Jan 18 | Cash A/c …Dr. | 32,000 | ||

| To Sales A/c | 32,000 | |||

| (Goods sold for cash) | ||||

| Jan 20 | Ashok …Dr. | 28,000 | ||

| To Sales A/c | 28,000 | |||

| (Goods sold to Ashok credit) | ||||

| Jan 25 | K. Murthy …Dr. | 35,000 | ||

| To Cash A/c | 34,200 | |||

| To Discount A/c | 800 | |||

| (Cash paid to K. Murthy in full settlement) | ||||

| Jan 28 | Cash A/c …Dr. | 20,000 | ||

| To Ashok | 20,000 | |||

| (Cash received from Ashok on Account) | ||||

| Jan 31 | Rent A/c …Dr. | 2,000 | ||

| To Cash A/c | 2,000 | |||

| (Cash paid for rent) | ||||

| Jan 31 | Drawings A/c …Dr. | 2,500 | ||

| To Bank A/c | 2,500 | |||

| (Cash withdrawn from bank for domestic use) |

Dr. Cash A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 1 | To Capital A/c | 50,000 | Jan 3 | By Bank A/c | 25,000 | ||

| Jan 18 | To Sales A/c | 32,000 | Jan 5 | By Furniture A/c | 5,000 | ||

| Jan 28 | To Ashok | 20,000 | Jan 8 | By Carriage A/c | 500 | ||

| Jan 25 | By K. Murthy | 34,200 | |||||

| Jan 31 | By Rent A/c | 2,000 | |||||

| Jan 31 | By Balance c/d | 35,300 | |||||

| Total | 1,02,000 | 1,02,000 | |||||

| Feb 1 | To Balance b/d | 35,300 |

Dr. Capital A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 31 | To Balance c/d | 50,000 | Jan 1 | By Cash A/c | 50,000 | ||

| Total | 50,000 | 50,000 | |||||

| Feb 1 | By Balance b/d | 50,000 |

Dr. Bank A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 3 | To Cash A/c | 25,000 | Jan 8 | By Purchase A/c | 15,000 | ||

| Jan 31 | By Drawings A/c | 2,500 | |||||

| Jan 31 | By Balance c/d | 7,500 | |||||

| Total | 25,000 | 25,000 | |||||

| Feb 1 | To Balance b/d | 7,500 |

Dr. Furniture A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 5 | To Cash A/c | 5,000 | Jan 31 | By Balance c/d | 5,000 | ||

| Total | 5,000 | 5,000 | |||||

| Feb 1 | To Balance b/d | 5,000 |

Dr. Purchase A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 8 | To Bank A/c | 15,000 | Jan 31 | By Trading A/c | 50,000 | ||

| Jan 14 | To K. Murthy | 35,000 | (Total transferred) | ||||

| Total | 50,000 | 50,000 |

Dr. Carriage A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 8 | To Cash A/c | 500 | Jan 31 | By Trading A/c | 500 | ||

| Total | 500 | (Total transferred) | 500 |

Dr. K. Murthy’s A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 25 | To Cash A/c | 34,200 | Jan 14 | By Purchase A/c | 35,000 | ||

| Jan 25 | To Discount A/c | 800 | |||||

| Total | 35,000 | 35,000 |

Dr. Sales A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 31 | To Trading A/c | 60,000 | Jan 18 | By Cash A/c | 32,000 | ||

| (Total transferred) | Jan 20 | By Ashok | 28,000 | ||||

| Total | 60,000 | 60,000 |

Dr. Ashok’s A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 20 | To Sales A/c | 28,000 | Jan 28 | By Cash A/c | 20,000 | ||

| Jan 31 | By Balance c/d | 8,000 | |||||

| Total | 28,000 | 28,000 | |||||

| Feb 1 | To Balance b/d | 8,000 |

Dr. Rent A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 31 | To Cash A/c | 2,000 | Jan 31 | By P&L A/c | 2,000 | ||

| Total | 2,000 | (Total transferred) | 2,000 |

Dr. Drawings A/c Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| Jan 31 | To Bank A/c | 2,500 | Jan 31 | By Balance c/d | 2,500 | ||

| Total | 2,500 | 2,500 | |||||

| Feb 1 | To Balance b/d | 2,500 |

(Note: The Discount A/c would also be opened and its total transferred to the P&L A/c.)

📚 Keep Studying!

We hope these Financial Management and Accounting notes help you build a strong foundation for your BBA. LuNotes is your one-stop solution for all Lucknow University notes. Don’t forget to check out our notes for other subjects in your semester!

[Link to Principles of Management Notes]

[Link to Personality Development Notes]

[Link to Complete Computer application Notes]

Found a mistake? We work hard to ensure all notes are 100% accurate and as per the latest LU syllabus. If you spot an error or have a suggestion, please [click here to report it]. (You would link this text to a contact form or email).

By LuNotes – your trusted for Lucknow University Semester exam notes, crafted with love. ❤️